Latest

American Finances Updates: Latest news on the Gas Prices Stimulus Check, 2022 Social Security COLA payments

Our live blog this Saturday March 19 brings you all the latest financial news from across the USA, outling the various benefits programs on offer, the latest developments in Social Security payments and the government’s response to rising gas prices and inflation.

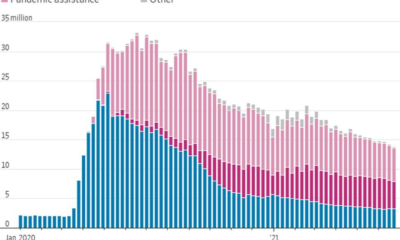

Many people in the United States have been left wondering what financial support is available in 2022, with stimulus checks now a thing of the past while some programs, like the expanded Child Tax Credit, have not yet been renewed. In this March 19 live blog, we will bring you the latest news and updates on the financial situation in the USA and what is on offer.

The COVID-19 pandemic has not gone away but now no longer carries the same threat as it did, so many of the programs available are for more general needs, such as helping citizens against the rise in inflation, the increase in gas prices and so on.

In response to the rising gas prices, there have been calls from Democrats in California for taxpayers to receive a 400 dollar tax rebate stimulus check, designed to help combat rising inflation and rising costs at the pump. That and other similar initiatives are discussed in more detail below.

As the most important cryptocurrency in the world, it’s always interesting to know which system is the one regulating the price of Bitcoin. Take a look at an in-depth analysis of everything worth knowing about this crypto.

The Lifetime Learning Credit is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution.

The LLC can help pay for undergraduate, graduate, and professional degree courses, including courses to acquire or improve job skills.

There is no limit on the number of years you can claim the credit. It is worth up to $2,000 per tax return.

If your Modified Adjusted Gross Income is between $59,000 and $69,000 ($118,000 and $138,000 if you file a joint return).

https://www.marca.com/en/lifestyle/us-news/2022/03/19/6236010f46163fac848b45aa.html

The cost-of-living adjustment (COLA) for 2022 in the United States was a 40-year high of 5.9 percent due to the higher rate of inflation brought about due to the COVID-19 pandemic, but this percentage is set to drop in 2023.

So far, following five months of the measuring period ahead of the January 2023 COLA for retirees, it currently stands at 3.9 percent – a decrease of two percent.

This is, however, a rise of 0.9 percentage points from February in the inflation index utilised to calculate the adjustment.

Read more about the COLA 2023 prediction.

The IRS is inviting U.S. taxpayers to file their taxes electronically this year, and it will be processed promptly.

The agency says Americans should apply for tax refunds – if they are due one – by direct deposit.

Mortgage rates rose above 4%, which hasn’t happened since May 2019, as a result of the Federal Reserve moving to curb inflation.

The move ends the Fed’s pandemic-era easy money policy after the central bank announced it would raise interest rates for the first time since 2018

The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, compared to 3.85% the previous week.

There are millions of Social Security recipients across the USA who have begun to receive increased payments this year thanks to the 5.9 percent cost-of-living-adjustment (COLA) increase.

The most recent payments went out on March 16 to those retirees born between the 11th and the 20th of the month. Anyone born from the 1st to the 10th has already had their money come through this March, while those with a birthday between the 20th and the 31st of the month will see their money arrive on March 23.

There are approximately 70 million Americans claiming Social Security payments, with the aforementioned 5.9 percent rise due to the COLA, which is a 1.3 rise compared to last year. Also, the maximum amount of money subject to the Social Security tax has also increased, going from 142,800 dollars in 2021 to 147,000 dollars in 2022. The Social Security tax rates are staying the same, which is 6.2 percent for employees and 12.4 percent for self-employed workers.

Read more about the latest batch of Social Security Payments.

As a result of Russia‘s invasion of Ukraine and the subsequent sanctions put upon Vladimir Putin’s country, gas prices in the USA have risen at a sharp rate.

In fact, for the first time in a decade, gas prices even went as high as four dollars a gallon. The previous high was set at 4.103 dollars per gallon back in 2008, but now a new high has been set with 4.104 dollars.

Nevertheless, oil prices are continuing to fall. In the last week the oil price decreased by 30 percent, following the spike caused by Russia‘s invasion of Ukraine.

Meanwhile, Democratic state lawmakers in California have suggested that taxpayers could receive a 400 dollar tax rebate check to help with the high costs of everyday expenses such as gas.

Read more about the Rising Gas Prices.

The Internal Revenue Service (IRS) has announced the standard mileage rate for the use of an automobile for business, charitable, medical or moving purposes

Taxpayers are advised to apply for the standard mileage rate in the first year that they are using the car for business purposes. Then, they will have the option to choose between this rate and the actual expenses.

The new rates came into effect back on January 1, 2022, and they are related to the use of cars including vans, pick-ups and panel trucks.

Read more about the Mileage Reimbursement Rate in 2022.

Many people across the USA will have been keen to get in their tax returns on time, knowing that down the line they are likely to receive a tax refund.

After all, the sooner that it is filed, the sooner you will get a refund. Since tax season got underway on January 24, the Internal Revenue Service (IRS) have returned at least 78 billion dollars to the US public.

In February 2021, the average tax refund was 2,880 dollars. However, this year it is 3,536 dollars on average. Therefore, the average amount received as a tax refund has increased 23 percent compared to last year.

Read more about IRS Tax Refunds.

The expanded Child Tax Credit payments has now come to an end in the United States, having been made available during the second half of 2021.

Families were able to receive 3,600 dollars for each child aged under the age of six, and 3,000 dollars for each child aged between six and 17. There was then the option to either receive half of this money on a monthly basis, or it could be received as a full lump sum once the individual had filed their 2021 taxes.

However, this expanded program has not continued into 2022 after an agreement could not be struck across all Democrats to support Joe Biden’s Build Back Better initiative. In particular, Sen. Joe Manchin was the opposing vote that caused the plans for the expanded Child Tax Credit program to fall through.

Read more about the plans with Child Tax Credit.

There has been a proposal from Mitt Romney, the senator from Utah for a new stimulus check to be made available for American families.

Through his Family Security Act proposal, eligible families with children up to five years of age would get $350 per month, while families with children between the ages of six and 17 would get $250 per month.

“Now is the time to renew our commitment to families to help them meet the challenges they face as they take on most important work any of us will ever do-raising our society’s children,” Romney said. It remains to be seen, though, if this measure will pass.

Read more about the Family Security Act 2022.

Given the way in which prices are rapidly rising in the USA, the US Federal Reserve have taken the decision to raise interest rates for the first time since 2018 in a bid to bring things back under control.

The benchmark rate will be lifted by 0.25 percent by the US central bank, and they have warned that further rate rises could follow in the months ahead. This comes against the rise in inflation in the USA, which hit a 40-year high of 7.9 percent in February.

Latest

A drug company abandoned a treatment for ‘bubble boy disease.’ After a 5-year fight, this little girl is about to get it

Later this spring, a little girl in California who essentially has no immune system will receive a lifesaving treatment for “bubble boy disease” thanks to the persistence of a dogged group of parents, a pediatrician, a veteran newsman and a few episodes of “Grey’s Anatomy.”

Five-year-old Seersha Sulack has the same rare disease portrayed in the 1976 John Travolta movie, “The Boy in the Plastic Bubble.” A germ – even a common cold – could kill her, and so she stays away from anyone outside her immediate family.

The treatment she’s been waiting for had stunning, near-perfect results in a clinical trial, but it’s been sitting on the shelf for years in the US because the pharmaceutical company that once owned the license abandoned it when it decided not to not to pursue approval from the US Food and Drug Administration.

“It’s a pretty tough situation,” said Dr. P.J. Brooks, acting director of the Division of Rare Diseases Research Innovation at the National Institute of Health’s National Center for Advancing Translational Sciences. “You have an effective therapy like (this one) and people can’t get access to it.”

Seersha is expected to get the treatment next month. She’ll become only the second child in the US in the past five years to receive it; the first child received it earlier this month.

The treatment is for a particular type of severe combined immunodeficiency called ADA-SCID that’s extremely rare – in the US, eight babies a year are born with it. Currently, 26 children in the US and Canada are on the waiting list to get the therapy, according to Dr. Donald Kohn, a UCLA scientist who has been working on the treatment for nearly 40 years.

The treatment is a type of gene therapy: Doctors will give Seersha a normal copy of the defective gene that disabled Seersha’s immune system.

Gene therapies hold great hope for all sorts of diseases, but they’re very expensive to develop, and pharmaceutical companies can’t be sure that they’ll make a profit because health insurance companies haven’t always agreed to pay the multi-million dollar price tags.

“It has not escaped our attention at FDA that there have been some clouds on the horizon in gene therapy,” Dr. Peter Marks, head of the US Food and Drug Administration’s Center for Biologics Evaluation and Research, said at a biotech conference in California in October. “We really want to try to see what we can do to move things forward.”

The gene therapy Seersha’s been waiting for was once called OTL-101, for Orchard Therapeutics Limited. Orchard launched in 2016 with OTL-101 as its “lead candidate,” but four years later, the company announced it would “reduce investment” in the therapy and prioritize treatments for more common conditions.

“A lot of us were upset and angry,” said Seersha’s mother, Shayla Sulack, noting that OTL-101 was developed with millions of dollars in state and federal government aid.

“We were always, ‘it’s going to happen, it’s going to happen,’ ” she added. Then, after Orchard decided not to pursue the therapy, “a bunch of us SCID moms were like, ‘Excuse me?’ ”

In a statement to CNN, an Orchard spokesperson wrote that “after encountering technical challenges related to the commercial-grade manufacture of this particular therapy, we made the very difficult decision to limit additional investment in [the SCID gene therapy].” The spokesperson spoke on the condition of anonymity.

A mother’s ‘oh, crap’ moment

Shayla and her husband, Stephen Sulack IV, were high school sweethearts at Tehachapi High School, about 100 miles north of Los Angeles. In 2010, when she was 18 and he was 19, they married at the Little White Wedding Chapel in Las Vegas.

Stephen was in the Army, and over the next few years, the young couple moved to various military bases. Their daughter Skylar was born in 2012 and son Stephen V in 2014.

In 2017, the family moved to Hawaii for Stephen’s new post as a Black Hawk helicopter pilot at Schofield Barracks in Oahu. Two weeks later, Seersha was born at Tripler Army Medical Center in Honolulu.

Weighing 6 pounds and 10 ounces, Seersha appeared perfectly healthy, and her parents took her on family outings, going to Dole Plantation and Waikiki Beach when she was five days old.

Strolling around the shops near the beach that day, the family went into a Tesla dealership just for fun. While sitting in a showroom car, Shayla got a phone call from a number she didn’t recognize.

It was a geneticist at Tripler. He told Shayla that a routine blood test, a prick on a newborn’s heel done in nearly every state, showed Seersha’s level of T cells – a type of white blood cell crucial to fighting off infections – was just five. Normal T cell levels for newborns are around 3,000.

This meant any infection, no matter how small, could kill Seersha. The geneticist said to bring her back to the hospital at Tripler immediately.

Shayla says her first reaction was: “Oh, crap.”

Not only had they been going everywhere with their new baby, but Seersha’s big brother and sister had been affectionately pawing all over her.

Shayla and Stephen left the Tesla dealership and made the 20-minute drive to the hospital while Shayla’s parents took the older two children home in their car.

At Tripler, doctors explained more about SCID, and a psychologist was on hand to help the Sulacks deal with the shocking news.

Only about one baby a year is born with the SCID in Hawaii, according to Sylvia Mann, genetics coordinator at the state’s department of health.

The next day, Shayla and Seersha were on a military medical transport flight to Los Angeles. Seersha was in an incubator in the front of the plane, and the other patients were kept in the back to decrease the chances they could get her sick.

An ambulance drove Shayla and Seersha to UCLA Mattel Children’s Hospital, one of 47 medical centers in the US and Canada that specialize in SCID as members of the Primary Immune Deficiency Treatment Consortium funded by the National Institutes of Health.

Once there, doctors laid out the options for saving Seersha’s life.

Options for Seersha

It turned out none of them were very good.

ADA-SCID is treated with regular injections to replace a missing enzyme that helps with immune function. They help a great deal, but they don’t give the child a full immune system, and their effectiveness can wane over time.

The UCLA doctors laid out two longer-term options. Seersha could receive a stem cell transplant, which is lifesaving and the standard treatment for SCID. Doctors would test her mother, father, brother, and sister and determine the best genetic match, and then would extract cells that specialize in forming blood cells and give them to Seersha.

Testing showed that any of her family members could donate to her, but none of them was a particularly good match. This was bad news for two reasons: One, the transplant likely wouldn’t be as effective. Two, Seersha would be more likely to suffer complications.

Latest

Youssef Ramadan earns ACC Men’s Swimmer of the Year

After his historical season, Youssef Ramadan took the ACC Men’s Swimmer of the Year title for the 2022-23 season, the league announced Monday afternoon.

Ramadan became the first-ever national champion in program history, swimming the second-fastest 100 fly time in NCAA history at 43.15. He earned five All-American awards and two honorable mentions at NCAA’s.

Ramadan was named male MVP at ACC’s in February for the second year in a row, on top of two gold medals and two silver medals. He also took ACC Male Swimmer of the Week twice earlier in the season.

Throughout the 2022-23 season, he’s broken four individual school records and two relay records.

Latest

Changes on tap for Americans who hunt waterfowl in Manitoba

Americans planning to hunt waterfowl this fall in Manitoba will be able to draw a seven-day license but must enter a lottery for a limited number of “foreign resident” licenses in subsequent years if they don’t book their trip through an outfitter, under new waterfowl regulations the province announced earlier this month.

“As part of the initial phase-in strategy for fall of 2023, Manitoba is ensuring that all applicants for the draw will receive a seven-day Foreign Resident Migratory Game Bird License,” Manitoba’s Ministry of Natural Resources and Northern Development said on its website. “In subsequent years the allocations for each license type will be determined based on license sales, hunter questionnaire data from all user groups and stakeholder input. The combination of the seven-day license and associated draw for freelance foreign resident hunters is intended to discourage visiting hunters from creating lasting systems of control that inhibit other hunters.”

The new regulations are a key component of the Waterfowl Hunting Modernization Project, a proposal the Manitoba government unveiled last fall before a 45-day comment period that ended Friday, Oct. 7.

American hunters will now have the opportunity to access the following Manitoba waterfowl and upland game bird licenses, the province said:

Foreign Resident Upland Game Bird License: Required to hunt upland birds and can be purchased online and is subject to the same regulatory framework as resident hunters.

Foreign Resident Migratory Game Bird License: Required to hunt migratory birds and is a seven-day license, which can be accessed either by entering a draw process or booking with a licensed outfitter.

Foreign Resident Legacy Migratory Game Bird License: A grandfathered opportunity for qualifying foreign resident landowners or lessees of Crown land.

To qualify for the special grandfathered provisions, Americans (and other foreign residents) must have owned property in Manitoba before Sept. 1, 2022, and still own that property; be a shareholder of a corporation owning registered property in Manitoba; or be a crown land lessee. Eligible land interest holders must also have hunted waterfowl in Manitoba during the previous five years between 2018 and 2022 to qualify for the legacy license.

-

Business3 years ago

Business3 years agoHyundai Leads Industry in U.S. News & World Report 2023 Best Cars for the Money Awards

-

Innovation3 years ago

Innovation3 years agoJay-S ventures into the urban genre with “Bailar en la Playa” his latest production

-

Business3 years ago

Business3 years agoThree Questions Small Business Owners Should Ask In Creating A Workplace Culture – Forbes

-

Business3 years ago

Business3 years agoA Fintech Makes It Easy For Small Businesses To Offer 401(k) Retirement Benefits – Forbes

-

Business3 years ago

Business3 years agoBritain’s Small Businesses See Better Times Ahead But Is Their Optimism Justified? – Forbes

-

Money3 years ago

Money3 years agoCharlie Crist leads Democratic gubernatorial field again in money chase – Florida Politics

-

Money3 years ago

Money3 years agoTesting New Tools for Horizon Worlds Creators To Earn Money

-

Business3 years ago

Business3 years agoSmall Business Labor Shortage – Forbes